The Syrian Commission on Financial Markets and Securities

Prof. Dr. Moustafa El-Abdallah Al- Kafry

The Syrian Commission on Financial Markets and Securities

(S C F M S)

I – History:

In the past few years, the Syrian economy has witnessed many reforms that dealt with all aspects of economic activity, and like other sectors, the financial sector had its share of these reforms in general and the securities sector in particular.

Hence Law No. 22 of 2005 establishing the Syrian Securities and Financial Markets Commission as a regulator linked to the Prime Minister and enjoying legal personality and financial and administrative independence and based in Damascus.

The (S C F M S) is considered the cornerstone of building the securities sector, which has been absent from the economic arena as well as from development considerations for a long time.

The (S C F M S) exercises its role in supervising and controlling the securities sector and related events, organizing and developing the activities of the primary market and its components, including joint stock companies, service and brokerage companies, and account inspectors through its directorates with its various specializations.

After completing the appropriate legislative and regulatory frameworks, the Authority proceeded at a rapid pace to complete the practical structure by opening the Damascus Securities Exchange in accordance with the requirements of trust and transparency and away from the manifestations of speculation and exploitation.

II – Vision and Mission:

Developing the securities and financial markets sector and its related activities and events in accordance with international standards and practices and by ensuring the principles of justice and transparency and developing investment awareness to enhance reform and development opportunities to consolidate a safe investment climate through:

- Work to deepen the efficiency of the securities sector to provide opportunities to attract savings in the interest of the national economy.

- Raising the efficiency of employees in the securities sector and consolidating their commitment to ethical principles and the optimal application of professional conduct standards.

- Consolidating the foundations of proper and fair dealing among various categories of investors to deepen their confidence and develop their investment awareness.

- Cooperation and coordination with Arab and international bodies to exchange advice and experiences.

- Developing legislation, rules and work systems to keep pace with international developments and standards to serve the market.

- Organizing and developing financial markets and related activities and events to ensure fairness, efficiency and transparency and contribute to reducing risks associated with securities transactions.

- Protect citizens and investors in securities from unfair or improper practices, or those involving fraud, fraud, fraud or manipulation.

- Encouraging savings and investment activity in the interest of the national economy.

III – Board of Commissioners of the Authority:

The Board of Commissioners consists of seven members, including four full-time members, including the Chairman of the Council and the Vice-Chairman of the Council with experience and competence, provided that they are Syrian natural persons, in addition to the Assistant Minister of Finance, the Assistant Minister of Economy and Trade and the Deputy Governor of the Central Bank of Syria.

The Board shall carry out all the functions of the Authority stipulated in Law No. 22 of 2005, as well as the regulations, rules and instructions issued pursuant thereto.

IV – Members of the Board of The Syrian Commission on Financial Markets and Securities:

Dr. Abdul Razzaq Qasim, The Chairman

Dr. Shadi Bitar, The Vice Chairman

Dr. Riad Abdel Raouf, Member

Ms. Rasha Karkouki, Member

Dr. Hussein Kabalan, Member

Dr. Maysoon Masri, Member

Mr. Bassam Alzarrad, Member

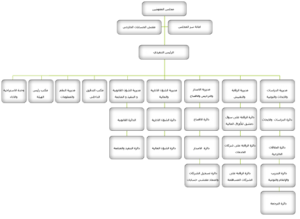

V – Organizational structure:

VI – Entities subject to the supervision of the Securities and Markets Authority:

1 – Companies issuing securities.

2 – Licensed services, investments and financial brokerage companies, divided into:

- Providing advice and analysis of information related to securities.

- Brokerage in securities.

- Manage initial releases.

- Investment management.

- Investment Secretariat.

- Faithful preservation

- Any services or activities approved by the Authority.

3 – Licensed banks, investment companies and mutual funds

4 – Financial markets.

5 – Accredited accounting and auditing companies and offices.